Engagement and activism may rebound

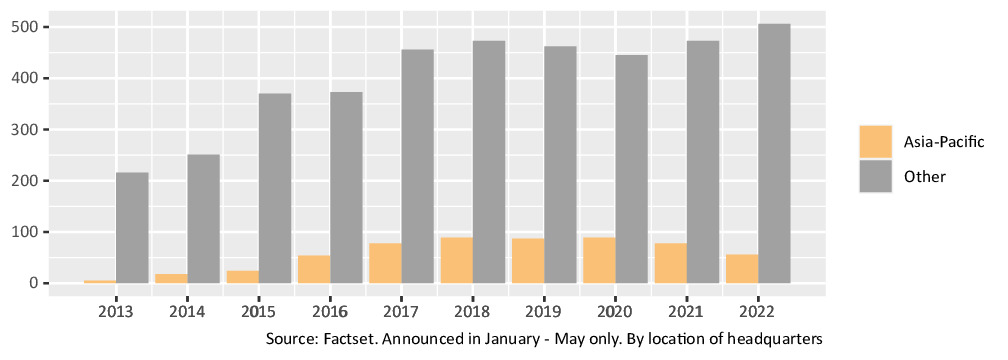

We looked at the Factset SharkWatch database, which tracks global activism campaigns for the last ten years. The dataset initially covered only US campaigns but in recent years has improved its non-US coverage to the extent that we believe it now provides meaningful statistics for Asia-Pacific.

The primary observation is that, while global activism has already started to rebound from the depths of the pandemic – rising 5.2% since 2020 – this growth has all been driven by campaigns outside Asia-Pacific. Figure 1 shows how Asia-Pacific activism (which accounts for around 17% of the total) is still down by 37% compared to 2020, even as the rest of the world has risen 13.7% (note that we considered only campaigns announced in January to May of each year, to make the results comparable across years).

Figure 1: Activist campaigns by region

Why the divergence? We believe it is simply explained by the fact that the three countries which account for 91.1% of the “rest of the world” dataset – namely the USA, Canada and the UK – have all been rolling back Covid restrictions faster than most countries in Asia-Pacific. This has made activism easier to execute and more effective in these markets.

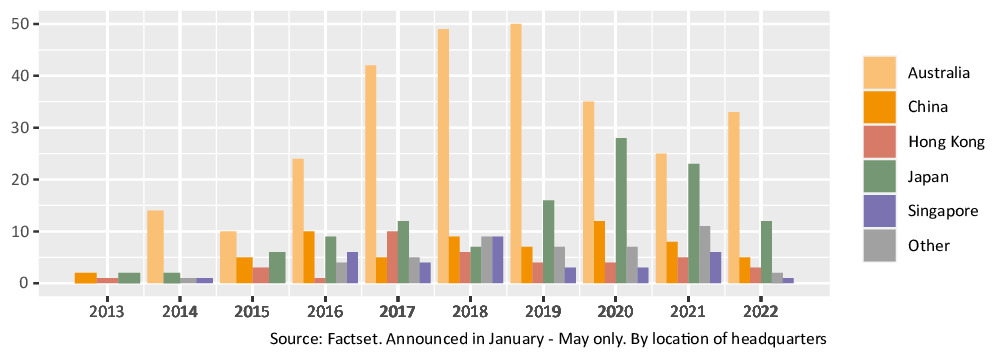

Figure 2: Asia-Pacific activist campaigns by region

Within Asia-Pacific, we see a similar trend. Activism targeting Australia-headquartered companies, which typically accounts for around half the regional total, has been rebounding in 2022 (figure 2), in line with Australia’s re-opening of its economy. Conversely, countries such as Japan and China which persist with closed border policies are still seeing activism falling year-on-year. (more…)