The new gold standard

Several positive developments in the corporate reform space occurred in January:

- Hanwha Corp., the apex of the Hanwha conglomerate, became the second major listed holding company in Korea to outline plans for reducing its share price discount to NAV, which currently stands at 63% on the company’s numbers.

In this respect it is following the lead of SK Square, which is the current “gold standard” among holding companies from a corporate governance perspective.

Hanwha’s approach is different to SK’s. While SK aims to reduce its discount via management incentives, Hanwha Corp. will focus on reducing the number of listed subsidiaries. According to Hanwha’s analysis, holdcos with fewer parts trade at smaller NAV discounts. Hanwha’s announcement is significant because it is now harder for other holding companies to explain why they’re not doing something similar.

To that end, Metrica last week initiated engagement campaigns against two new targets, valued at 0.22x and 0.25x NAV by the market. - On 22nd January, President Lee reiterated his support for the ”Stock Price Suppression Prevention Act” and instructed his chief policy officer to work on immediate implementation. We first wrote about this bill in May 2025. It seeks to prevent majority owners reducing inheritance taxes by driving down share prices ahead of succession events. The bill would treat listed companies the same as unlisted companies, setting a valuation floor of 0.8x NAV.

Naturally, this bill will encounter opposition from the conglomerates, but President Lee already has a track record of pushing through reform-oriented legislation, so we are optimistic about the prospects for this bill, which will have a meaningful impact on the valuations of affected names. - Also on the 22nd, President Lee highlighted the issue of duplicate listings. This refers to chaebols creating multiple layers of subsidiaries to solidify control while depressing share prices to save on inheritance tax.

Duplicate listings are bad for minority investors and most stock exchanges globally are against them. They are however prevalent in Korea (18% of the market) for historical reasons. Japan used to be in a similar position but now only has 4% thanks to Tokyo Stock Exchange initiatives.

We wrote about this issue in April 2025, when the Korea Exchange blocked SK Innovation’s spin-out of its subsidiary SK Enmove. Now the president himself is calling out conglomerates such as LS and LG for spinning off subsidiaries against the interests of minority shareholders.

LS has been shamed into withdrawing its plans, and it seems that spin-off IPOs by other conglomerates are also on ice. The next catalyst for this trade will be when the KRX releases newguidelines in Q1, with a corresponding Capital Markets Act revision to come. Metrica expects this to generate further trading opportunities in this space.

Sources:

Will Dual Listings, the ‘KOSPI 5000 Obstacle,’ Disappear?, The Asia Business Daily, 26 Jan 2026

History does repeat

In 2024, excitement over the Value-up programme gave way to pessimism as President Yoon’s unpopularity meant nothing got done. Many of the listed stocks which should have benefited from Value-up – namely, those where corporate governance or capital allocation concerns were depressing the share price – rallied sharply but then fell back later in the year, in many cases to below preannouncement levels.

When President Lee replaced President Yoon, “KOSPI 5000” took over as the banner for a new collection of reform measures. And similar to 2024, the initial announcement drove a huge rally in the affected names, but by the end of the year, the market’s attention had drifted elsewhere and many of the same names had fallen sharply back.

Current levels only make sense if Korea reforms are getting derailed a second time, and so far, the evidence doesn’t point that way. The main difference with 2024 is that President Lee has a strong mandate to get things done, and he has so far shown an admirable focus on following through with his campaign promises. Two revisions of the Commercial Act have been passed, and a third is on the way. Corporates have responded by increasing share buybacks and cancellations while publishing plans to improve shareholder value creation. Investors have correspondingly reacted by using the reforms as a platform to mount campaigns targeting poor governance and inefficient capital allocation. Given the political willpower plus strong buy-in by multiple capital market participants, the reform momentum looks set to continue for the foreseeable future.

Carrots and sticks redux

We recently participated in a panel discussing corporate reform focusing on Japan and South Korea. As evidenced by the strong turn-out, interest in this topic is very high. In general, the panel was optimistic on the prospect of Korea corporate reform eventually replicating the success of Japan. While the Korean market naturally has its own long-standing and wellknown structural challenges – deriving mainly from the dominance of founding families – the significant rise in retail ownership in recent years should continue to incentivise politicians to push ahead with reforms even when faced with fierce resistance from entrenched interests.

In this context, both “carrots” and “sticks” are critical to the long-term success of the reform programme.

President Lee has achieved admirable progress with the “sticks”. The expansion of directors’ fiduciary duties and implementation of cumulative voting should go a long way to limit the recurrence of the bad behaviour seen in recent years, as will the upcoming treasury share cancellation proposals when enacted. On the “carrot” side, the upcoming dividend taxation changes are important, as they should encourage companies to raise payout ratios, making stocks more attractive to domestic retail investors when compared to alternatives such as real estate.

However, more is needed if Korea is to make progress similar to Japan:

- We need to see reforms to the inheritance tax system, which currently incentivises major shareholders to drive down share prices around succession events. A tax rate reduction would be helpful, but even better would be taxation of assets on fair value instead of an artificially depressed market price. The “0.8x proposal” mentioned in our May newsletter could be an ideal solution. We look forward to seeing the government’s inheritance tax reform roadmap early next year.

- We would like to see more engagement by the stock exchange. In our recent discussion, one panellist said that Mr. Yamaji (Group CEO of Japan Exchange Group) was “the greatest activist investor in Japan”, and we share that sentiment. For its part, the Korea Exchange (KRX) has made good progress with promoting the 2024 Corporate Value-up programme via seminars, website disclosures and custom indexes etc. Nevertheless, the take-up rate among listed corporates still remains rather low at only 7%7. Korea needs something similar to Japan’s “Management that is Conscious of Cost of Capital and Stock Price” policy, i.e. whereby companies that have not submitted Value-up plans have to explain themselves annually. We attended a seminar by Mr. Jeong of the KRX recently and came away optimistic that he will develop further ways to advance the reform programme within the Korean context.

- Finally, investors must play their part in advancing all aspects of the reform agenda. While Korean shareholder activism has greatly increased in the last two years, much of this has been focused on governance items such as board appointments. What is also needed are more Japan-style campaigns focusing on capital allocations and balance sheet efficiency. While there has been some activity along these lines in 2025, we expect further developments in 2026. In particular, we are closely monitoring the current selection process for the next head of the National Pension Service, as the appointment of a reform-minded candidate would be a very significant positive.

The good news is that valuations in names affected by corporate governance reform in Korea are still very attractive even after the market’s impressive run in 2025, and although the path to success may not be a straight line, we ultimately expect significant return potential from the fund’s positions in this space.

The twin themes

In Korea, it was good to see the second set of amendments to the Commercial Act passed on 25 August. Listed companies with assets exceeding two trillion won will now have to adopt cumulative voting, making it dramatically easier for minority shareholders to get at least one candidate onto the board.

The next set of amendments to the Commercial Act, scheduled for later this year, will include the mandatory cancellation of treasury shares.

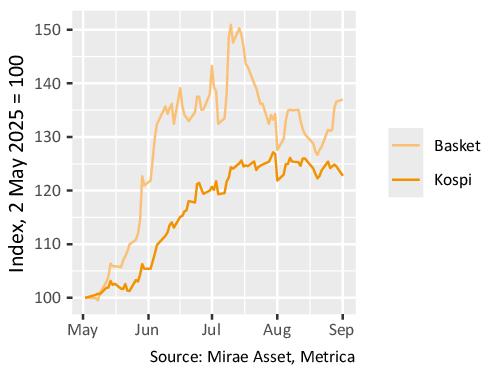

Treasury shares have been a focus topic in the Korean market since Lee Jae Myung initiated his presidential campaign, with a basket of treasury share-heavy holding companies beating the index by around 25% at one point (figure below).

Performance of a basket of holding companies with large treasury share holdings, May 2025 to present

The reason is that, in the past, treasury shares have often been misused to defend management rights against hostile takeovers or shareholder activism. Consequently, the ruling Democratic Party of Korea is proposing that companies must cancel their treasury shares within a certain timeframe, which has not been determined yet but is likely to be immediate to one year for newly-acquired treasury shares, and six months to five years for existing holdings.

Korea’s business community has inevitably voiced strong opposition to these measures, arguing that treasury shares are a strategic tool for defending management control, such that rapidly cancelling decades’ worth of accumulated shares would be not only impractical but would also leave companies exposed to foreign hostile takeovers.

Given the progress made to date on other reform measures, Metrica is reasonably confident that the government will be able to push through the treasury share cancellation bill with timeframes on the shorter end. This will improve transparency in the market and reduce the ability of companies to use treasury shares for illegitimate purposes.

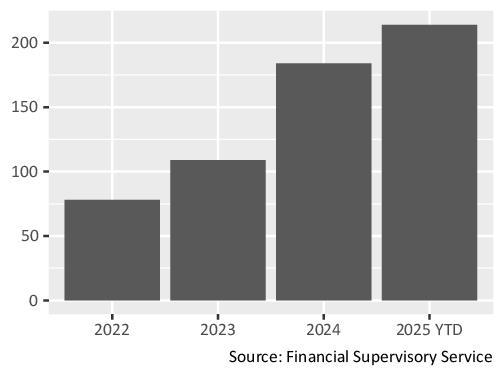

Some companies have already been ramping up cancellations (figure below), spurred by the “Value-up” initiatives of former President Yoon and an increased focus on corporate governance by domestic investors.

Treasury share cancellation announcements by listed firms in South Korea

Taking care of business

Korea’s President Lee is a month into his term, and so far he has remained admirably focused on promoting the “KOSPI 5000” agenda.

A long-awaited bill to reform the Commercial Act just passed the National Assembly as this newsletter went to print, and it includes provisions expanding the duty of care of corporate directors from “companies” to “companies and shareholders”, mandating electronic general shareholder meetings for large companies and limiting the voting rights of shareholders and related parties to 3% when electing audit committee members.

By implementing these reforms, the government is acting against the express wishes of the chaebols, who have campaigned loudly against them. It is strong evidence that the incoming administration is able to get things done. It also reflects recognition that, with almost a third of Korean people having brokerage accounts, anyone threatening to derail the stock market’s 30% year-to-date rally would be playing a dangerous game.

Taxes are another area of focus. Following the discussions on inheritance tax changes for listed shares – outlined in last month’s newsletter – the government is turning its attention to dividends.

Currently, all financial income including dividend income is taxed at 15.4% below KRW 20 million, and at progressive rates of up to 49.5% above KRW 20 million. The National Planning Committee and Ministry of Economy and Finance are considering eliminating the progressive rate schedule so that everything is taxed at 15.4%.

Historically, chaebols have been reluctant to pay anything more than nominal dividends to their owners due to the high tax burden. If President Lee’s dividend tax reform goes ahead, it should encourage operating subsidiaries to raise payouts, which would be positive for the valuations of the listed holding companies that own them.